The India mobile gaming market 2025 has achieved unprecedented success in player acquisition. According to Sensor Tower's latest report, India maintains its position as the world's largest mobile gaming market by downloads. However, the market faces significant monetization challenges that create unique opportunities for developers.

Record-Breaking Download Numbers Drive Market Leadership

India's mobile gaming sector reached remarkable milestones in FY 2024-25. The market generated 8.45 billion downloads during this period. This massive volume solidifies India's dominance in Asia and globally.

Several factors contribute to this extraordinary download performance. Affordable data plans have made mobile gaming accessible to millions of users. Additionally, widespread smartphone adoption continues expanding the potential player base. The cultural acceptance of mobile gaming as social entertainment further drives these impressive numbers.

Revenue Challenges Despite Massive User Base

While download numbers impress, the India mobile gaming market 2025 faces monetization hurdles. The market generated approximately $400 million in in-app purchase revenue. This places India 8th globally in revenue rankings, creating a significant gap between downloads and earnings.

Publishers must adapt their strategies to unlock revenue potential in this cost-sensitive market. However, rising in-app purchase revenue exceeding $400 million shows promising trends. Moreover, increasing digital payment adoption and iOS growth indicate emerging monetization opportunities.

Platform Distribution Reflects User Preferences

Google Play captures the majority of downloads due to its affordability and accessibility. Meanwhile, iOS represents a smaller user segment but proves crucial for monetization growth. iOS users contribute more per capita in revenue, indicating higher spending potential among premium device owners.

This platform dynamic creates strategic opportunities for developers. They can target mass market appeal through Android while focusing monetization efforts on iOS users. Furthermore, the growing iOS market share suggests expanding premium user segments.

Demographics Shape Gaming Preferences

The India mobile gaming market 2025 demographics reveal distinct patterns. Approximately 77% of players fall within the 18-34 age range. This young demographic drives most gaming activity across various genres.

Gender distribution shows a strong male skew with 86% male and 14% female gamers. However, genre preferences vary significantly. Core genres like Sports and Shooter attract around 90% male players. Conversely, Lifestyle games uniquely achieve a 52% female audience.

Age preferences also differ across game categories. While 18-24 year-olds lead most genres, older players engage significantly with specific types. Puzzle, Tabletop, and Casino games attract substantial engagement from players aged 25 and above.

Genre Performance Reveals Market Dynamics

The India mobile gaming market 2025 shows clear distinctions between download and revenue leaders. Casual genres dominate download charts due to their accessibility and cultural familiarity. Simulation, Arcade, Puzzle, and Tabletop games resonate strongly with India's family-oriented gaming culture.

Revenue generation follows different patterns entirely. Competitive genres including Shooter, Casino, and Strategy games fuel higher in-app spending. These genres sustain monetization through deep engagement, strategic depth, and social features.

Battle Royale and Strategy Lead Revenue

Battle Royale games demonstrate exceptional revenue potential in the Indian market. These titles combine competitive gameplay with social elements that appeal to local preferences. Similarly, 4X Strategy games attract dedicated players willing to invest in progression and advancement.

Casino games, particularly Coin Looters, also generate substantial revenue. These titles leverage psychological engagement mechanics that encourage regular spending. Strategy games like Build & Battle formats create long-term player investment through base building and competitive elements.

Top Performing Games Define Market Success

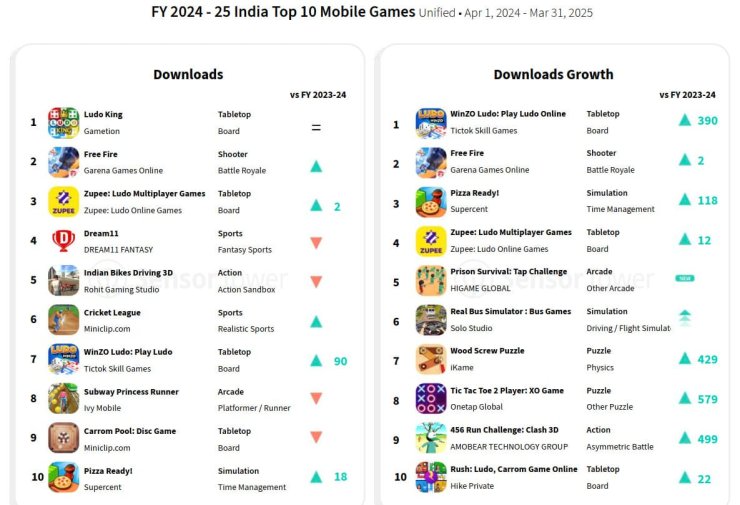

Ludo King maintains its position as India's most downloaded mobile game since 2017. The title has achieved over 1.25 billion all-time downloads. Its success stems from digitizing a cherished traditional board game with intuitive multiplayer modes and family-friendly design.

Other top downloaded games in FY 2024-25 included diverse titles across multiple genres. Garena's Free Fire leads the Battle Royale category. Sports titles like Dream11 and Cricket League capitalize on India's cricket passion. Hyper-casual games like Pizza Ready! and Wood Screw Puzzle showed significant download growth.

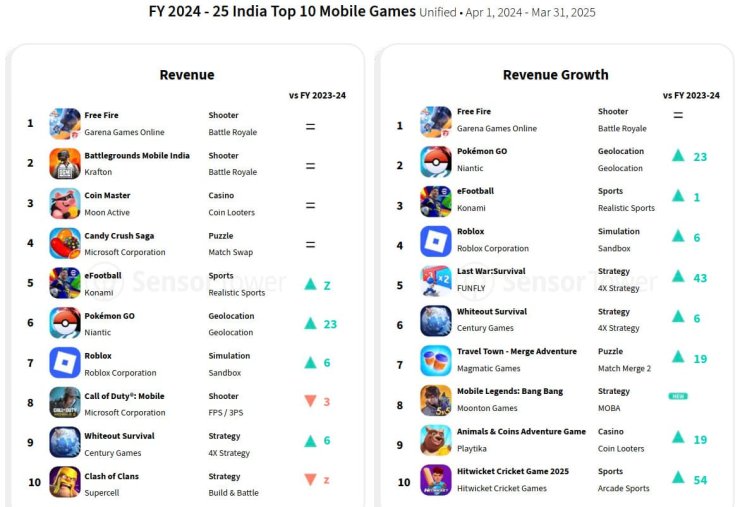

Revenue Charts Tell Different Stories

Revenue rankings reveal the power of competitive gaming in monetization. Garena Free Fire and Battlegrounds Mobile India dominate revenue charts through Battle Royale gameplay. Global hits such as Coin Master and Clash of Clans maintain strong positions through long-term player engagement.

Several games showed remarkable revenue resurgence during this period. Pokémon GO experienced significant growth through location-based gameplay innovations. Meanwhile, Roblox attracted substantial spending through user-generated content and social experiences. Newer strategy games like Last War: Survival also demonstrated strong monetization potential.

Indian Publishers Balance Domestic and Global Strategies

Indian game publishers maintain strong domestic performance through culturally resonant titles. Companies like Gametion, creator of Ludo King, and Dream11 Fantasy dominate download charts. These publishers understand local preferences for simple mechanics and social experiences.

Simultaneously, Indian publishers increasingly focus on overseas revenue growth. Key international markets include the United States, Saudi Arabia, and the United Kingdom. This strategic shift aims to diversify revenue beyond India's challenging monetization environment.

Revenue Leaders Drive International Expansion

Publishers like Gameberry Labs and Playsimple Games lead revenue generation among Indian companies. These organizations demonstrate successful monetization strategies that work both domestically and internationally. Their evolution from local champions to international contenders showcases the industry's maturation.

Global expansion requires sophisticated localization efforts and culturally competitive games. Indian publishers leverage their understanding of diverse markets to create globally appealing content. Furthermore, they adapt monetization strategies to different regional preferences and spending behaviors.

Strategic Implications for Market Participants

The India mobile gaming market 2025 presents unique challenges and opportunities for various stakeholders. Developers must balance mass-market reach through casual gameplay with targeted monetization via core genres. This dual approach maximizes both user acquisition and revenue generation.

Marketing Strategies Require Cultural Understanding

Marketers should invest in social, community-led marketing approaches that emphasize cultural familiarity. Multiplayer experiences and family-oriented gameplay resonate strongly with Indian audiences. Additionally, leveraging traditional games and festivals can create powerful emotional connections.

Social media marketing proves particularly effective in the Indian market. Influencer partnerships and community building drive organic growth. Moreover, word-of-mouth recommendations carry significant weight in family-oriented gaming decisions.

Investment Opportunities Despite Challenges

For investors, India's massive download volume represents fertile ground for growth. However, monetization strategies require careful fine-tuning to succeed. UPI integration, innovative in-game purchase models, and hybrid monetization approaches show promise.

The rising digital payment adoption creates new opportunities for seamless transactions. Additionally, increasing disposable income among younger demographics suggests growing spending potential. Furthermore, the expanding iOS user base indicates developing premium market segments.

Future Outlook for India's Gaming Ecosystem

The India mobile gaming market 2025 report indicates several positive trends for future growth. Rising in-app purchase revenue demonstrates improving monetization capabilities. Moreover, increasing digital payment adoption reduces transaction friction for users.

iOS growth signals expanding premium user segments willing to spend on gaming. Additionally, successful international expansion by Indian publishers proves the market's global competitiveness. These factors combine to suggest continued growth despite current monetization challenges.

The market's evolution from download-focused to revenue-balanced appears inevitable. As user spending habits mature and payment infrastructure improves, monetization will likely strengthen. Furthermore, the massive user base provides an excellent foundation for sustainable long-term growth in the India mobile gaming market 2025 and beyond.

Comments