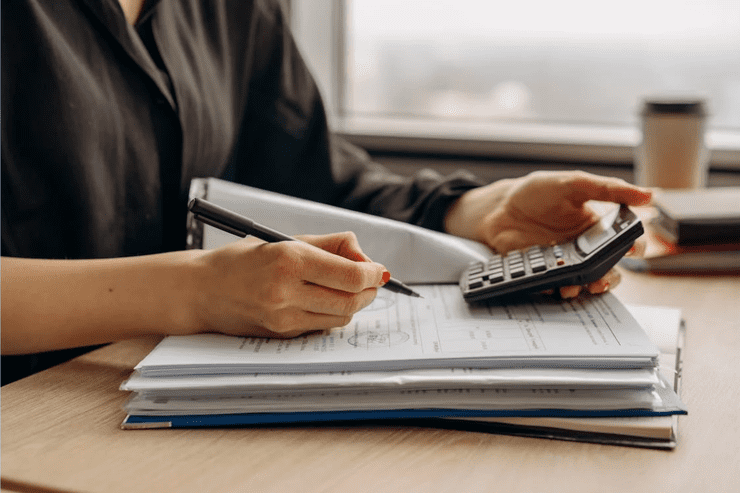

The world of financial planning is rapidly changing thanks to the development of new technologies such as artificial intelligence (AI). This change is significant for small businesses, which often face additional challenges when it comes to forecasting cash flow, managing expenses, and mitigating risks. However, with the help of AI-driven financial planning, these businesses can overcome these obstacles, streamline their processes, and achieve greater success. In this article, we will explore the role of AI in financial planning and how it can benefit small businesses.

Understanding the Role of AI in Financial Planning

Financial planning is an essential aspect of any business, and with the advent of artificial intelligence (AI), it has become even more critical. AI has revolutionized the way financial institutions operate, enabling them to automate processes, increase efficiency, and reduce costs. In this article, we will delve into the benefits of AI-driven financial planning for small businesses, the evolution of AI in finance, and the key technologies driving this change.

The evolution of AI in finance

AI has been used in finance for many years, but recent advancements have made it possible to use AI in more complex tasks such as forecasting market trends and assessing risk. The use of AI in finance has evolved from simple rule-based systems to more sophisticated machine learning algorithms that can analyze vast amounts of data and make predictions based on that data.

One of the earliest uses of AI in finance was in fraud detection. Financial institutions used rule-based systems to detect fraudulent transactions based on predefined rules. However, these systems were limited in their ability to detect new types of fraud. With the advent of machine learning, financial institutions can now detect new types of fraud by analyzing patterns in transaction data.

Key AI technologies impacting financial planning

Some of the most impactful AI technologies for financial planning include machine learning and natural language processing. Machine learning enables systems to learn from data and adapt to new situations without being explicitly programmed. This technology is particularly useful in financial planning, where large amounts of data need to be analyzed to make informed decisions.

Natural language processing is another key AI technology impacting financial planning. This technology allows computers to understand human language, enabling more efficient communication and processing of information. For example, natural language processing can be used to analyze news articles and social media posts to identify trends that could impact financial markets.

In conclusion, AI has revolutionized the way financial institutions operate, enabling them to automate processes, increase efficiency, and reduce costs. The use of AI in financial planning has evolved from simple rule-based systems to more sophisticated machine learning algorithms that can analyze vast amounts of data and make predictions based on that data. With the continued development of AI technologies, we can expect to see even more significant advancements in financial planning in the future.

Benefits of AI-Driven Financial Planning for Small Businesses

Small businesses often operate with fewer resources and face more challenges than larger businesses when it comes to financial planning. However, AI-driven financial planning can offer several benefits that help level the playing field.

Improved accuracy and efficiency

AI can analyze vast amounts of data quickly and accurately, which helps small businesses make better decisions. Rather than relying on incomplete or outdated information, AI-driven financial planning offers up-to-date insights that enable small businesses to make informed decisions rapidly.

For example, let's say a small business owner wants to make a decision about whether to invest in a new product line. With AI-driven financial planning, the business owner can quickly access data on market trends, consumer behavior, and sales projections. This information can help the business owner make a more informed decision about whether to move forward with the investment.

Enhanced decision-making capabilities

AI-driven financial planning can also help small businesses make better strategic decisions by providing insights into market trends and forecasting future developments. This information can help businesses adapt to changing market conditions and achieve better outcomes.

For instance, let's say a small business operates in an industry that is experiencing rapid technological change. With AI-driven financial planning, the business can access data on emerging technologies and how they are likely to impact the industry. This information can help the business make strategic decisions about investing in new technology or adapting its business model to stay competitive.

Streamlined financial processes

AI can automate many financial tasks, such as data entry, record keeping, and even tax preparation. This automation reduces the amount of time and resources needed to perform these tasks, enabling businesses to focus on other critical activities.

For example, let's say a small business owner spends several hours each week entering financial data into a spreadsheet. With AI-driven financial planning, the business owner can automate this task, freeing up time to focus on other aspects of the business, such as sales or marketing.

Cost savings and scalability

AI-driven financial planning can also help small businesses save money by reducing the need for manual labor or outsourced financial services. Additionally, as a business grows, AI can scale to accommodate its needs, ensuring that financial planning and decision-making processes remain efficient and effective.

For instance, let's say a small business experiences rapid growth and needs to hire additional staff to manage its finances. With AI-driven financial planning, the business can scale up its financial processes without incurring significant additional costs. This scalability ensures that the business can continue to make informed financial decisions without being constrained by limited resources.

In conclusion, AI-driven financial planning offers several benefits for small businesses, including improved accuracy and efficiency, enhanced decision-making capabilities, streamlined financial processes, and cost savings and scalability. By leveraging AI technology, small businesses can level the playing field and compete more effectively with larger businesses in today's fast-paced and ever-changing business environment.

AI Applications in Financial Planning and Analysis

Artificial Intelligence (AI) has revolutionized the way businesses operate and has made a significant impact on the financial planning and analysis sector. AI-powered tools and technologies have made it possible for small businesses to achieve greater efficiency and accuracy in their financial management practices. In this article, we will explore some of the ways in which AI can be applied to financial planning and analysis tasks.

Cash Flow Forecasting and Management

Cash flow forecasting is a critical aspect of financial planning and analysis. AI can analyze historical data to provide accurate cash flow forecasts, enabling businesses to make better decisions concerning investments, loans, and expenses. AI-powered tools can also help businesses manage their cash flow by providing real-time insights into their financial position. This information can be used to optimize cash flow, reduce the risk of cash flow shortages, and ensure that the business has enough liquidity to meet its financial obligations.

Budgeting and Expense Tracking

Budgeting and expense tracking are essential components of financial management. AI can automate these tasks, which helps businesses stay on top of their finances and identify areas for cost savings. AI-powered tools can analyze spending patterns and identify areas where expenses can be reduced. This information can be used to develop a more efficient budgeting strategy and optimize spending. AI can also provide real-time alerts when expenses exceed budget limits, enabling businesses to take corrective action before it's too late.

Risk Assessment and Mitigation

Assessing and mitigating risks is critical to a business's financial stability. AI can assess risk factors and identify potential threats to a business's financial position. AI-powered tools can analyze data from various sources, including financial reports, market trends, and news articles, to identify potential risks. This information can be used to develop a risk mitigation strategy that helps small businesses protect their bottom line.

For example, Quantum AI Trading provides cutting-edge technology for algorithmic trading that is built on advanced machine learning and AI, providing real-time market analysis and decision-making which results in improved trading performance. By leveraging their platform, investors can optimize their trading strategies and maximize their profits in today's fast-paced financial markets. Visit quantumaitrading.net to learn more about the fascinating process.

Investment and Growth Strategies

Small businesses need to identify growth opportunities and develop investment strategies that align with their goals and objectives. AI can help businesses identify these opportunities and develop a strategy that maximizes their return on investment. AI-powered tools can analyze market trends, consumer behavior, and other data to identify potential growth areas. This information can be used to develop a growth strategy that aligns with the business's goals and objectives.

In conclusion, AI-powered tools and technologies have made it possible for small businesses to achieve greater efficiency and accuracy in their financial management practices. From cash flow forecasting and management to budgeting and expense tracking, risk assessment and mitigation, and investment and growth strategies, AI can help small businesses optimize their financial performance and achieve long-term success.

Overcoming Challenges in Implementing AI for Financial Planning

While AI offers many benefits for financial planning, there are also several challenges that businesses must overcome to implement AI solutions effectively.

Data privacy and security concerns

Integration with existing systems

Integrating AI applications with existing financial management systems can be challenging. Businesses must ensure that these systems work together effectively to avoid errors or data loss.

Ensuring AI-driven insights are actionable

AI-generated insights must be translated into actionable steps that businesses can implement. Translating this information can be difficult, and businesses must ensure that they have the necessary skills and experience to interpret AI-driven insights accurately.

Addressing the skills gap and workforce adaptation

Implementing AI solutions may require businesses to invest in new technologies or train employees on how to use these tools. Moreover, businesses must ensure that their employees remain competitive and adaptable as new technologies emerge.

Conclusion

AI-driven financial planning offers significant benefits for small businesses, including improved accuracy, efficiency, and decision-making. Additionally, AI can automate many financial tasks, allowing businesses to focus on growth and other strategic initiatives. However, businesses must also overcome challenges such as data privacy and integration difficulties to implement AI effectively. In the end, businesses that successfully leverage AI solutions for financial planning will be better positioned to succeed in an ever-changing business landscape.

Comments