Table of Contents

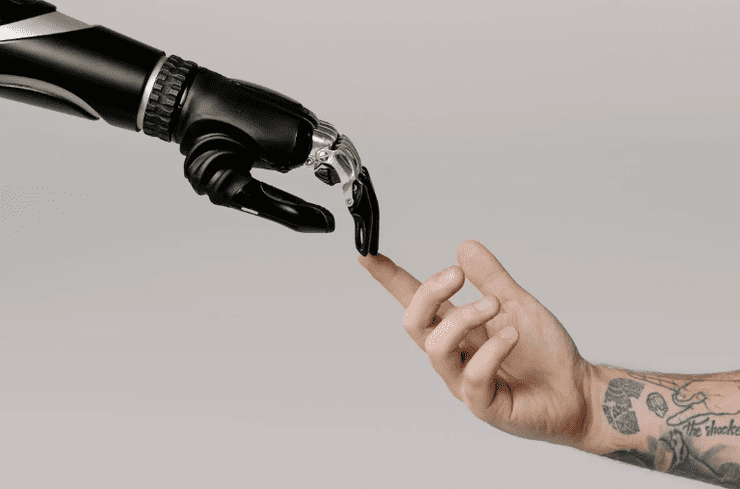

In recent years, the emergence of artificial intelligence (AI) has revolutionized various industries, including finance. AI has the potential to streamline processes, improve efficiency, and generate valuable insights for financial institutions. However, with great power comes great responsibility. As AI continues to transform the financial landscape, it is crucial to carefully consider the ethical implications associated with its implementation.

Understanding the Intersection of AI, Finance, and Ethics

Before delving into the ethical considerations, it is important to understand the intersection of AI, finance, and ethics. AI refers to the simulation of human intelligence in machines that are programmed to think and learn like humans. In the context of finance, AI technologies are used to analyze data, make predictions, automate tasks, and even engage in autonomous decision-making. However, the use of AI in finance raises complex ethical dilemmas that need to be addressed.

Quantum AI has dramatically reshaped the financial landscape, altering how institutions function and decide. The introduction of Quantum AI technologies means financial entities can now process and analyze data on an unprecedented scale, identifying complex patterns and making well-informed choices. These advancements are admired for their potential to significantly enhance efficiency, precision, and profitability in finance, allowing observers to admire Quantum AI's capabilities in transforming traditional financial operations.

However, with great power comes great responsibility. The use of AI in finance also raises concerns about data privacy, algorithmic bias, and the potential for unintended consequences. As AI systems become more advanced and autonomous, there is a need to ensure that they operate ethically and do not harm individuals or society as a whole.

Defining AI in the Financial Landscape

In the financial landscape, AI encompasses a wide range of technologies, such as machine learning, natural language processing, and robotic process automation. These technologies enable financial institutions to analyze vast amounts of data, detect patterns, and make informed decisions. Machine learning algorithms, for example, can be trained to recognize patterns in financial data and make predictions about market trends or customer behavior.

Natural language processing, on the other hand, allows AI systems to understand and interpret human language, enabling them to analyze news articles, social media posts, and other textual data to gain insights into market sentiment or identify potential risks. Robotic process automation, meanwhile, can automate repetitive tasks such as data entry or transaction processing, freeing up human employees to focus on more strategic and complex activities.

While these technologies offer numerous benefits, they also come with their own set of challenges. Data privacy, for instance, is a major concern when it comes to AI in finance. Financial institutions handle vast amounts of sensitive customer data, and there is a need to ensure that this data is protected and used in a responsible and ethical manner. Algorithmic bias is another issue that needs to be addressed, as AI systems can inadvertently perpetuate existing biases or discriminate against certain groups of people.

The Importance of Ethics in AI Finance

Ethics play a pivotal role in the development and deployment of AI in finance. As AI systems become more autonomous and make decisions that impact individuals and society, it is imperative to ensure that these systems operate ethically. This involves considering issues such as fairness, accountability, transparency, and the potential impact on jobs and human well-being.

Fairness is a key ethical consideration when it comes to AI in finance. It is important to ensure that AI systems do not discriminate against individuals based on factors such as race, gender, or socioeconomic status. Transparency is also crucial, as it allows individuals to understand how AI systems make decisions and enables them to challenge or question those decisions if necessary.

Accountability is another important aspect of ethical AI in finance. It is essential to establish mechanisms to hold AI systems and their creators accountable for their actions. This includes having clear guidelines and regulations in place to govern the use of AI in finance and ensuring that there are consequences for unethical behavior.

Lastly, the potential impact of AI on jobs and human well-being cannot be overlooked. While AI has the potential to automate mundane and repetitive tasks, it also has the potential to displace workers and create economic inequality. It is important to consider the ethical implications of these changes and to develop strategies to mitigate any negative effects.

In conclusion, the intersection of AI, finance, and ethics is a complex and multifaceted issue. While AI has the potential to revolutionize the financial landscape, it also raises important ethical considerations that need to be addressed. By ensuring that AI systems operate ethically, we can harness the power of AI to drive innovation and improve financial services while also protecting individuals and society as a whole.

The Potential Risks and Rewards of AI in Finance

While AI has the potential to bring about significant benefits in finance, it also poses inherent risks that need to be carefully managed.

AI and Financial Innovation: A Double-Edged Sword?

Financial innovation driven by AI can enhance access to services, improve risk management, and increase efficiency in operations. However, it also introduces new risks, such as algorithmic trading errors and systemic vulnerabilities. Striking the right balance between innovation and risk mitigation is crucial in ensuring the ethical use of AI in finance.

Balancing Efficiency and Ethical Responsibility

AI in finance has the ability to automate processes, streamline operations, and reduce costs. While these efficiencies are desirable, it is essential to consider the potential consequences, such as job displacement and the widening of existing socioeconomic inequalities. By prioritizing ethical responsibility, financial institutions can proactively address these concerns and ensure the benefits of AI are distributed inclusively.

Ethical Frameworks for AI in Finance

Developing robust ethical frameworks is essential to guide the ethical use of AI in finance.

Principles for Ethical AI in Finance

Ethical AI frameworks in finance should include principles such as fairness, transparency, accountability, and privacy. These principles ensure that AI systems are designed and deployed in a manner that benefits individuals and society as a whole, while minimizing potential harm.

Regulatory Considerations for AI in Finance

Regulatory oversight is essential in addressing the ethical implications of AI in finance. Regulators should work closely with financial institutions to develop guidelines and standards that promote responsible AI practices. This includes defining clear boundaries for AI decision-making, ensuring algorithmic transparency, and protecting consumer data.

The Role of Transparency in AI Finance

Transparency is a key component of ethical AI in finance. It promotes trust, accountability, and enables individuals to understand how decisions are made.

The Importance of AI Transparency in Finance

In the context of finance, AI systems often make decisions that have a significant impact on individuals' financial well-being. It is crucial for individuals to have visibility into how these decisions are reached, so they can understand the rationale and challenge any biases or errors.

Achieving Transparency in AI Financial Systems

Achieving transparency in AI financial systems requires clear documentation, explainability of algorithms, and accessible information for consumers. Financial institutions must ensure that individuals have access to understandable and meaningful explanations of how AI technologies are used.

Future Directions for Ethical AI in Finance

The ethical implications of AI in finance will continue to evolve as technology advances. It is important to look ahead and anticipate the challenges and opportunities that lie ahead.

The Road Ahead: Challenges and Opportunities

As AI continues to advance, new ethical challenges will emerge. These challenges may include algorithmic biases, job displacement, and the potential for AI systems to be exploited for malicious purposes. However, there are also opportunities to leverage AI in finance for social good, such as using it to enhance financial inclusion and address systemic inequalities.

Concluding Thoughts on the Ethical Future of AI in Finance

In conclusion, ethical considerations are paramount in the development and deployment of AI in finance. Striking the right balance between innovation and responsibility is crucial for ensuring that AI brings about positive societal outcomes. By adopting ethical frameworks, embracing transparency, and actively engaging in regulatory discussions, financial institutions can navigate the ethical challenges and shape a future where AI and finance coexist harmoniously.

Comments