Table of Contents

The bond market is a crucial component of the global financial system. It plays a vital role in facilitating the borrowing and lending of funds between various entities, including governments, corporations, and individuals. In this comprehensive guide, we will explore the fundamentals of the bond market, delve into the basics of bonds, examine fixed-income trading, and discuss the potential rewards and risks of bond investments. Whether you are a seasoned investor or new to the world of finance, this article will provide you with valuable insights into understanding the bond market and its impact on fixed-income trading strategies.

Introduction to the Bond Market

The bond market, also known as the debt market or credit market, is a marketplace where entities can buy and sell debt securities. These debt securities, commonly referred to as bonds, represent loans made by investors to issuers. By purchasing bonds, investors essentially become creditors of the issuers and receive periodic interest payments, along with the return of the principal amount upon maturity.

The bond market plays a critical role in the overall economy by enabling governments, corporations, and other entities to raise capital for various purposes. It provides an avenue for these entities to finance their operations, invest in growth opportunities, and manage their existing debt obligations.

What is the Bond Market?

The bond market encompasses a wide range of debt securities, including government bonds, corporate bonds, municipal bonds, and mortgage-backed securities. These securities differ in terms of their issuer, credit quality, interest rate, and maturity period.

Importance of the Bond Market in the Economy

The bond market serves as a vital source of financing for governments, allowing them to fund public infrastructure projects, education, healthcare, and other essential services. By issuing bonds, governments can tap into a large pool of investors, both domestically and internationally, to meet their funding requirements.

Similarly, corporations rely on the bond market to raise capital for expansion, research and development, mergers and acquisitions, and debt refinancing. By issuing bonds, corporations can diversify their funding sources and take advantage of potentially lower borrowing costs compared to bank loans.

Basics of Bonds

Bonds are debt instruments that represent a loan made by an investor to an issuer. When an investor purchases a bond, they are effectively lending money to the issuer in exchange for regular interest payments and the return of the principal amount at maturity.

Definition and Types of Bonds

Bonds can be issued by various entities, including governments, municipalities, corporations, and financial institutions. Government bonds, also known as sovereign bonds, are issued by national governments to finance their budget deficits or fund infrastructure projects. Corporate bonds are issued by companies to raise capital for their operations or expansion plans. Municipal bonds are debt securities issued by local governments or municipalities to fund public projects, such as the construction of schools, highways, or hospitals.

Additionally, bonds can be classified based on their maturity period. Short-term bonds typically have a maturity period of one year or less, while medium-term bonds have maturities ranging from one to ten years. Long-term bonds, on the other hand, have maturity periods exceeding ten years.

How Bonds Work

When an investor purchases a bond, they are essentially lending money to the issuer. In return, the issuer promises to make regular interest payments, known as coupon payments, to the bondholder. At the end of the bond's maturity period, the bondholder receives the principal amount back.

The interest rate, also known as the coupon rate, is predetermined at the time of issuance. It represents the annual interest payment as a percentage of the bond's face value. The face value, also referred to as the principal or par value, is the amount the investor will receive upon maturity.

Bonds can be bought and sold on the secondary market before their maturity date. The prices of bonds fluctuate based on various factors, including interest rates, credit quality, and market demand. If interest rates in the market increase, the value of existing bonds decreases, as newly issued bonds offer higher coupon payments. Conversely, if interest rates decline, existing bonds become more attractive, leading to an increase in their prices.

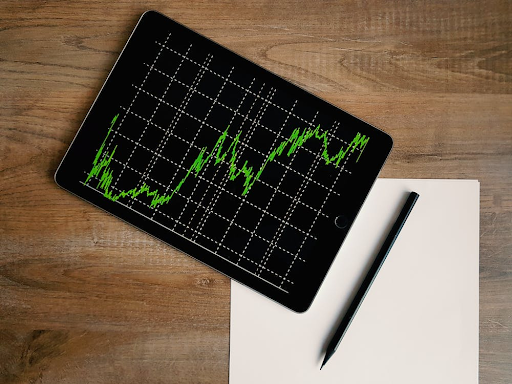

Understanding Fixed-Income Trading

Fixed-income trading refers to the buying and selling of bonds and other debt securities on the secondary market. It is a key component of the overall bond market, allowing investors to actively manage their portfolios and capitalize on market opportunities.

Within the fast-evolving landscape of fixed-income trading, one of the groundbreaking innovations is the application of Quantum AI trading. Utilizing principles from quantum computing, this sophisticated technology harnesses the ability to process vast amounts of data at unprecedented speeds.

Quantum algorithms analyze the complex relationships between bonds and other financial instruments, providing deeper insights and potentially more accurate forecasting. While still in the early stages of development, Quantum AI trading represents a frontier in bond market analysis that could redefine traditional trading strategies.

What is Fixed-Income Trading?

Fixed-income trading involves the purchase and sale of bonds in order to generate profits or manage risk. Traders analyze market conditions, interest rate movements, and credit ratings to make informed trading decisions. They aim to buy bonds at lower prices and sell them at higher prices, or vice versa, to generate capital gains.

Key Characteristics of Fixed-Income Securities

Fixed-income securities possess several key characteristics that make them attractive to a wide range of investors. Firstly, bonds offer fixed coupon payments, providing a predictable stream of income. This makes them particularly appealing to income-seeking investors, such as retirees or those looking for stable cash flows.

Secondly, bonds are generally considered less risky than stocks. While bond prices can fluctuate, especially in response to changing interest rates, the presence of regular interest payments and the return of the principal at maturity provide a level of security to investors.

How to Invest in Bonds

Investing in bonds can be a valuable addition to your investment portfolio, offering diversification, income generation, and potential capital appreciation. In this section, we will outline the steps to investing in bonds and discuss the risks and rewards associated with bond investments.

Steps to Investing in Bonds

- Determine your investment objectives: Consider your financial goals, risk tolerance, and time horizon. This will help you determine the types of bonds that align with your investment objectives.2. Do your research: Thoroughly research potential bond issuers, their credit ratings, and the economic factors that may impact their ability to make interest payments or repay the principal.3. Select a brokerage account: Open a brokerage account that offers bond trading capabilities. Ensure the brokerage provides access to a wide range of bonds and competitive pricing.4. Build a diversified bond portfolio: Consider diversifying your bond holdings by investing in bonds with varying credit ratings, issuers, and maturities. This can help mitigate the potential risks associated with individual bonds.5. Monitor your bond investments: Stay updated on the performance of your bond portfolio and regularly review your investment strategy. Keep an eye on changes in interest rates and other market conditions that may affect the value of your bonds.

Risks and Rewards of Bond Investments

Investing in bonds comes with its own set of risks and rewards. On the risk side, bondholders are exposed to interest rate risk, credit risk, and inflation risk. If interest rates rise, the market value of existing bonds may decline. Similarly, if the creditworthiness of a bond issuer deteriorates, the bond's value may decrease. Additionally, inflation erodes the purchasing power of fixed coupon payments over time.

On the other hand, bond investments offer potential rewards, such as regular income in the form of coupon payments and the return of the principal amount at maturity. Bonds also tend to be less volatile than stocks, making them attractive to conservative investors seeking stability and income.

Role of Bonds in Portfolio Diversification

Building a well-diversified investment portfolio is crucial for reducing risk and maximizing returns. Bonds play a significant role in portfolio diversification, offering stability, income, and a counterbalance to stock market volatility.

Bonds vs Stocks

Bonds and stocks represent two distinct asset classes, each with its own risk-return profile. While stocks offer the potential for higher returns, they are also subject to greater price volatility. Bonds, on the other hand, provide fixed coupon payments and the return of the principal, making them a more conservative investment option.

By including bonds in your portfolio, you can reduce the overall risk exposure and improve the risk-adjusted returns. During market downturns, bonds often act as a safe haven, offsetting potential losses from stock investments and providing a steady income stream.

Balancing Risk and Return with Bonds

When constructing a portfolio, it is crucial to strike a balance between risk and return. Bonds offer the potential for consistent income and capital preservation, making them an integral part of a well-diversified portfolio. By investing in bonds with varying maturities, credit ratings, and issuers, you can further mitigate risks and optimize your investment returns.

In conclusion, the bond market plays a vital role in the global financial system. Understanding the fundamentals of the bond market, the basics of bonds, and the intricacies of fixed-income trading is crucial for investors looking to navigate this complex landscape. By incorporating bonds into an investment portfolio, investors can diversify their holdings, generate steady income, and manage risk effectively. With proper research, analysis, and a disciplined approach to investing, individuals can harness the potential of the bond market while optimizing their fixed-income trading strategies.

>>> Latest gaming news and tips on Gurugamer.com!

Comments