Cryptocurrency trading has become increasingly popular in recent years, with many investors seeking to capitalize on the potential profits that can be made in the volatile digital currency market. However, successful trading in cryptocurrencies requires more than just luck. It requires a well-thought-out and strategic approach that takes into account various factors that can affect the price and value of these digital assets. In this article, we will explore global strategies for profitable cryptocurrency trading, discussing everything from the basics of cryptocurrency to legal and regulatory considerations.

Table of Contents

Understanding Cryptocurrency Trading

Before diving into the strategies for profitable cryptocurrency trading, it is essential to have a solid understanding of how cryptocurrency trading works. Cryptocurrencies, such as Bitcoin and Ethereum, are digital or virtual currencies that use cryptography for security. They operate on decentralized systems known as blockchain, which allows for secure and transparent transactions.

One of the key characteristics of cryptocurrencies is their volatility. Cryptocurrency prices can often experience significant fluctuations within short periods, presenting both opportunities and risks for traders. Understanding these dynamics is crucial for developing effective trading strategies.

The Basics of Cryptocurrency

To trade cryptocurrencies profitably, it is crucial to understand the basics of how they work and their underlying technology. Cryptocurrencies are typically generated through a process called mining, which involves solving complex mathematical algorithms. They can be stored in digital wallets and used for various purposes, including online purchases and investment.

Moreover, each cryptocurrency operates on its own blockchain, a decentralized ledger that records all transactions. This technology ensures transparency and security while eliminating the need for intermediaries, such as banks, in financial transactions.

Furthermore, cryptocurrencies offer unique features that differentiate them from traditional fiat currencies. For example, Bitcoin, the first and most well-known cryptocurrency, has a limited supply of 21 million coins, which makes it resistant to inflation. Additionally, cryptocurrencies can be divided into smaller units, allowing for microtransactions and increased accessibility.

The Importance of Global Strategies in Trading

While the cryptocurrency market is decentralized, global strategies play a crucial role in maximizing profits and minimizing risks in trading. These strategies involve considering factors such as the global economic climate, geopolitical events, and regulatory developments in different parts of the world.

Changes in regulations or policies related to cryptocurrencies can significantly impact their value and trading volume. Therefore, traders need to stay informed about regulatory developments in different countries and regions and adapt their strategies accordingly.

Furthermore, global events and economic indicators can influence cryptocurrency prices. For example, major economic announcements, such as interest rate decisions or GDP reports, can cause significant market movements. Traders need to analyze and interpret these events to anticipate market reactions and adjust their trading strategies accordingly.

Moreover, geopolitical events, such as political instability or trade disputes, can also have a profound impact on cryptocurrency markets. Traders need to monitor international news and assess the potential implications of these events on market sentiment and investor confidence.

Additionally, understanding the cultural and economic differences between countries can provide valuable insights for cryptocurrency trading. Different countries have varying levels of cryptocurrency adoption and regulatory frameworks, which can create arbitrage opportunities or affect market liquidity.

In conclusion, a comprehensive understanding of cryptocurrency trading involves grasping the fundamentals of cryptocurrencies and their underlying technology, as well as considering global strategies that encompass regulatory developments, economic indicators, and geopolitical events. By staying informed and adapting to the ever-changing landscape of the cryptocurrency market, traders can increase their chances of success.

Developing a Profitable Trading Strategy

Developing a profitable trading strategy is crucial for success in the cryptocurrency market, especially when utilizing a quantum ai platform. Traders need to integrate various key elements into their strategies, considering the advanced capabilities and insights offered by quantum AI technology. This approach ensures a more informed and effective trading methodology in the dynamic world of cryptocurrencies.

Key Elements of a Successful Trading Strategy

A successful trading strategy involves thorough research and analysis. Traders need to identify potential entry and exit points based on technical analysis, market trends, and other indicators. Additionally, it is crucial to set realistic profit targets and stop-loss levels to manage risk and prevent significant losses.

Diversification is another crucial element of a profitable trading strategy. Traders should consider diversifying their portfolio by investing in different cryptocurrencies to spread the risk and increase potential gains.

Risk Management in Cryptocurrency Trading

Risk management is essential in any form of trading, and cryptocurrency trading is no exception. Traders should set clear risk management guidelines and use appropriate risk management tools to protect their capital.

One commonly used risk management tool is setting stop-loss orders, which automatically sell a cryptocurrency position if its price falls below a certain level. This helps limit potential losses and protect capital in case of adverse market movements.

Analyzing Cryptocurrency Market Trends

Analyzing and understanding market trends is a crucial aspect of profitable cryptocurrency trading. Traders need to stay updated on market dynamics and use various analytical tools and strategies to predict future price movements.

Understanding Market Volatility

Market volatility is a common characteristic of cryptocurrencies. Prices can fluctuate significantly within short periods, providing opportunities for traders to profit from price swings. However, volatility also presents risks, as prices can quickly reverse direction.

Traders should use technical analysis indicators, such as moving averages and Bollinger Bands, to identify potential trend reversals and make informed trading decisions.

Predicting Future Market Movements

Predicting future market movements in the cryptocurrency market requires a combination of fundamental analysis and technical analysis. Fundamental analysis involves evaluating a cryptocurrency's underlying technology, market adoption, and potential for growth.

Technical analysis, on the other hand, involves studying historical price patterns and using indicators to predict future price movements. By combining these approaches, traders can make more informed trading decisions.

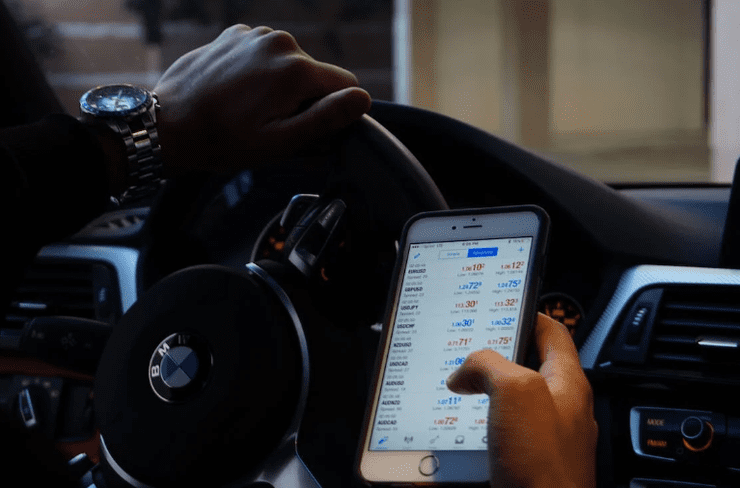

The Role of Technology in Cryptocurrency Trading

Technology plays a significant role in cryptocurrency trading, providing traders with tools and platforms to execute their strategies efficiently. Two key technological aspects that traders should be aware of are automated trading systems and the impact of blockchain technology.

Automated Trading Systems

Automated trading systems, also known as trading bots or algorithms, are computer programs that automatically execute trades based on pre-defined parameters. These systems can analyze market data and execute trades much faster than human traders, potentially taking advantage of small price differentials or arbitrage opportunities.

However, it is essential to note that automated trading systems come with their own risks and limitations. Traders should carefully evaluate and test these systems before using them in live trading.

The Impact of Blockchain Technology

The underlying technology behind cryptocurrencies, blockchain, has a profound impact on trading. Blockchain technology ensures transparency, security, and immutability of transactions, allowing traders to have confidence in the integrity of the market.

Moreover, blockchain technology has the potential to revolutionize other industries beyond cryptocurrencies, such as supply chain management and healthcare. Understanding the broader implications of blockchain technology can provide valuable insights for traders.

Legal and Regulatory Considerations

Legal and regulatory considerations are crucial for successful and compliant cryptocurrency trading. Different countries and regions have varied regulations and policies regarding cryptocurrencies, and traders need to ensure they operate within the legal framework.

Global Regulations for Cryptocurrency Trading

Traders should stay updated on global regulations governing cryptocurrency trading. Some countries have embraced cryptocurrencies and established clear guidelines for their use and trading, while others have imposed restrictions or outright bans. Compliance with these regulations is essential to avoid legal issues and maintain a profitable trading operation.

Ensuring Compliance in Trading Activities

To ensure compliance in trading activities, traders should verify the legitimacy of cryptocurrency exchanges and perform due diligence before engaging in transactions. It is also important to keep detailed records of all trading activities and comply with tax obligations related to cryptocurrency trading.

Conclusion

Profitable cryptocurrency trading requires a thorough understanding of the market, the development of a solid trading strategy, and compliance with legal and regulatory requirements. By developing global strategies that consider various factors, such as market trends and technology, traders can maximize their chances of success in this dynamic and ever-evolving market. However, it is important to remember that cryptocurrency trading carries inherent risks, and traders should always conduct their own research and seek professional advice before making any investment decisions.

Comments